-

Chapter 13: GOODS AND SERVICE TAX

Introduction

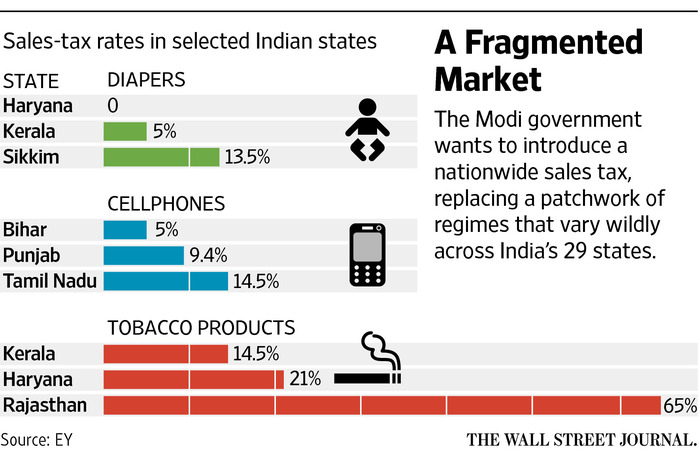

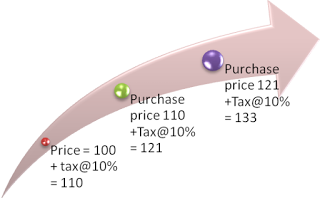

Sales tax system is bad as it has a cascading effect on the price. It is a tax on tax. If the merchant sells without bill there is no record and hence no liability. Due to the opaque system it leads to increase in corruption and also the tax revenue is lost.

Sales tax system works as follows: suppose a mobile of Rs 10000 is sold buy the company to retailer, the retailer pays 1000 which is 10% as sales tax to government. Now the tax has to be recovered from the user so the price of the mobile increases to 11000. The retailer makes an addition of Rs. 500 to the price of the mobile which is his value added charge or profit. Now the value of the mobile is 10000+1000+500. While selling this to the consumer he has to pay tax of Rs. 1150 to the government. This charge has to be borne by the consumer and so the price of the mobile increases to 11500+1150 = Rs. 12650.

Fig 1: Cascading effect of taxes

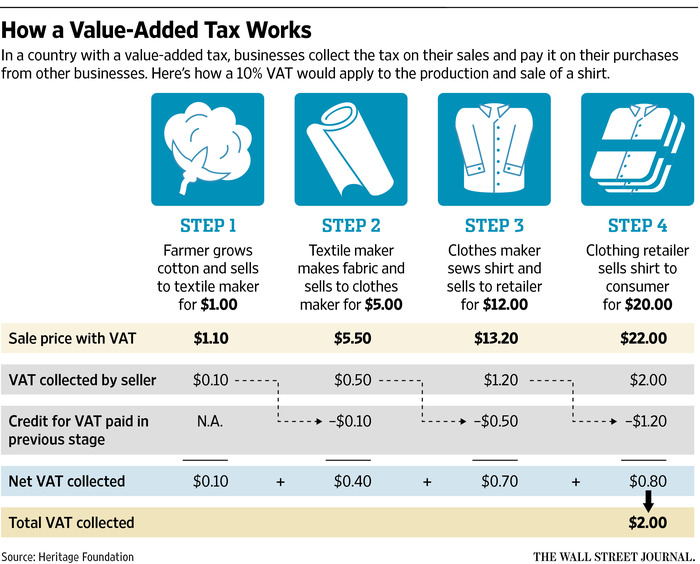

To

counter this system we move to Value Added Tax. VAT is

also borne by the final consumer but the burden is less as

it isn’t a tax on tax. The working of the VAT system is as

follows: suppose a mobile of Rs 10000 is sold buy the

company to retailer, the retailer pays Rs. 1000 which is

10% as VAT

to government. The retailer makes an addition of

Rs. 500 to the price of the mobile which is profit. Now

the value of the mobile is 10000+1000+500.

While selling this to the consumer he has to pay

tax of Rs. 50 to the government. This Rs. 50 is the 10%

tax on the value added by him which was Rs.500. This

charge has to be borne by the consumer and so the price of

the mobile increases to 11500+50 = Rs. 11550.

Hence VAT isn’t a tax on tax. Also for VAT the dealer has to maintain a tax invoice and tin number due to which the tax can’t be avoided. This increases the tax collection.

MODVAT: Modified VAT

In the manufacturing process, the excise duty has to be borne on individual items of the manufactured product. For example, in manufacturing of car the excise duty has to be placed on wheels, tires, seats, screws as well as the entire assembly of car. This too is a tax on tax and has a cascading effect. To avoid this, the excises paid on the individual items are credited and excise is levied on final item only.

Central VAT: CENVAT

In the manufacturing process, the service tax paid on any services used or the excise paid on raw materials and components both is credited back when the final good is made. The tax is imposed only on the final goods.

Even though the CENVAT and MODVAT have improved the tax collection, the problems of VAT system are there due to which there is a need for a GST.

Problems of VAT :1. Taxes on commodities are multiple and imposed at state as well as central level. These include electricity tax, advertisement tax, central sales tax, tax on fuels, service tax and excise duty. Though some as credit due to CENVAT but not all.

2. No standard VAT rate across states. States demand share in Cess and surcharges.

3. Retailers have formed cartels to create false invoices to reduce VAT liability.

Benefits of GST over VAT:

1. Services are covered. Uniform tax rates. Most Cess and surcharge will be removed. Covers most union and state direct and indirect taxes. Minimum exceptions to it.

2. Cooperative federalism as a GST council will be formed with finance minister [chairman] + minister of state for finance + FM of states. The union shall have 1/3rd voting power and states 2/3rd voting power.

3. GST council shall decide which Cess , taxes, surcharges to subsume and too exempt.

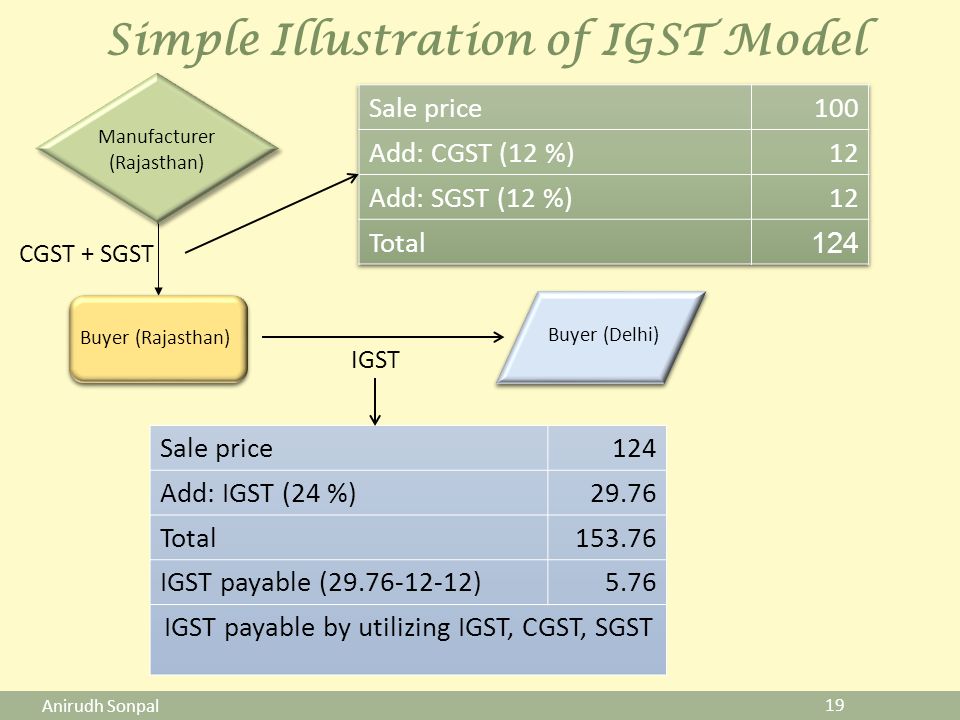

4. GST system of India shall have three components central GST, state GST and integrated GST [not a tax but system].

5. Currently customs duty, customs Cess, excise duty + GST on tobacco products, petroleum products kept outside GST till council decide date.

Advantages of GST:

1. GST expands tax base, eliminate tax barriers and creates a national economy. Most of the taxes, Cess and surcharge shall be subsumed. The tax rate shall be lowered and tax base can be increased.

2. The central sales tax was an origin based tax and the exporter state would get the credit. The high cost of transportation and other liabilities while transporting goods increased the price of it. To offset this, the MNCs would build warehouses in all states to reduce tax liability. This was unfavorable to MSMEs as they couldn’t compete with MNCs.

3. To combat this we have IGST which is made of CGST and SGST. The CGST shall be transferred to union and the SGST is transferred to importing state not exporting state. The IGST has been levied by union.

4. Due to the presence of central and state indirect taxes company do in-house production of everything to reduce tax liability. But now after GST these shall be subsumed by a single tax. All tax on inputs shall be credited and hence there is no advantage for in-house production of everything.

5. Thus GST shall create MSMEs, jobs, subcontracting, outsourcing and increase tax base.

6. GST shall benefits that exports shall be zero rated as all input taxes shall be credited. But for credit bills and tin have to be saved. This would mean that the system will be transparent and no evasion or bribery possible.

7. The GST shall be computed on the same base and won’t be a tax on tax so no cascading effect e.g. For a mobile of Rs. 10000 the CGST and SGST shall both be say 10% of Rs 10000 and so consumer finally has to pay less.

Challenges of GST:

1. High revenue neutral rate will lead to evasion, smuggling and low compliance. But solution is increasing tax base and no exemptions.

2. Destination based tax not good for industrialized states. Solution anonymous GST fund with tapering effect.

3. Union to make a robust ICT infrastructure, he would have to coordinate with 30 states for credit; state it officials need to be trained as they are inept. It infrastructure missing at state level.

Dual Control over Tax Assessees

GST shall have dual control by the states and center over small assessees i.e. upto Rs. 1.5 crore turnover. The assessees shall be divided randomly in a 90:10 ratio for the purpose of audit and scrutiny between the center and the states. No assessee shall have to face dual audit. Also assessees above the threshold of Rs. 1.5 crore shall be divided in 50:50 ratio and face scrutiny either from the states or the center.

The states have also been given the power to tax economic activity within 12 nautical miles of the territorial waters. The Center has shown great flexibility by allowing such concessions. GST shall make a major impact on the Nation’s economy and this is possible only by taking the states together in this endeavour.

Goods and Services Tax Network - GSTN

Goods and Service Tax Network [GSTN] is a non government, private limited company which was given a non recurring grant by the government. It has 49% equity held by Center and the States and remaining 51% held by private lenders like HDFC, ICICI etc.

The purpose of creation of such a company is to provide IT infrastructure for all stakeholders to implement the GST. Since the GSTN is substantially funded by the Center the audit powers shall be to the CAG. The CAG shall appoint an auditor and can conduct a supplementary audit of it just like it does for other government companies.

Goods and Services Tax - Land & Real Estate

Land and real estate transactions are the biggest source of black money and the ambit of the GST should be widened to bring all of these under it. This doesn’t mean bringing the Stamp duty also under it or the tax on agricultural land.

These are the main concerns of the State governments fearing loss of revenue. The other fear is that a new tax shall make low cost housing costly. However houses with carpet area less than 60 sq m can be kept out of the purview of GST.

The GST shall be levied on the sale of houses either readymade property or on sale of land or real estate to develop it. Current system doesn’t allow tax credits on inputs required for land and real estate projects like iron, steel, cement etc. is not done. This increases the taxation burden to atleast 12%.

The readymade property is however not taxed under current regulations. Therefore this must be changed and a uniform tax can be levied. The readymade property is not taxed but again there are no tax credits on inputs that were needed for the property.

If GST is levied on both types of services then the accounts of the inputs needed for construction of land and real estate projects shall be needed. This will be required for getting tax credits and so a system of self policing shall be brought into effect.

The other reform that is needed is the GST on the sale of land itself (non agricultural). Thus now land shall be covered under the GST and when this land is sold for redevelopment and other purposes the tax credit on the land can be claimed. Thus the person who bought the land can get a profit. This shall also discourage non payment of tax or benami transactions as full disclosure is needed for claiming of tax credit.

Political will is needed as many of the bigger states have refrained from supporting the center on this issue.

Solved Question Papers

Q.The main objective of the 12th Five-Year Plan is (UPSC CSAT 2014)

inclusive growth and poverty reductions

inclusive and sustainable growth

sustainable and inclusive growth to reduce unemployment

Faster, sustainable and more inclusive growth.

Ans . D

Q.What does venture capital mean? (UPSC CSAT 2014)

A short-term capital provided to industries

A long-term start-up capital provided to new entrepreneurs

Funds provided to industries at times of incurring losses

Funds provided for replacement and renovation of industries

Ans . B

Venture capital, seed funding, angel funding are offered to capable entrepreneurs.