-

Chapter 3: NEW ECONOMIC POLICY - 1991

Introduction

The

year 1991 saw a financial crisis on the government that acted as

a catalyst for economic reforms. The crisis was due to several

factors like the gulf war that pushed up oil prices and lower

remittances from gulf, foreign reserves at all time low,

hyperinflation occurring at the same time.

This forced the government to launch a new set of economic policy measures was needed to combat these. The government approached the International Bank of Reconstruction and Development [I.B.R.D] aka World Bank and the International Monetary Fund [ I.M.F ] to give a loan. The financial assistance came with a rider to open up the economy and remove restrictions on the private sector. This set of measures was announced in 1991 as the New Economic Policy.

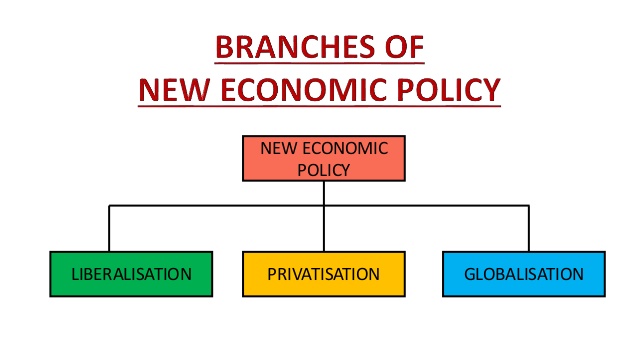

Fig 1: New Economic Policy

The

policy had measures which came under two heads: Stabilization

measures [short term measures to control inflation and correct

balance of payments] and Structural reform measures [improve

efficiency of economy and increase international

competitiveness by removing rigidity in various economic

segments]. The policy focused on liberalization,

privatization and its outcome was globalization.

Liberalization measures:

1. Deregulation of industrial sector – removal of licenses, deregulation of sectors for private entry, removal of price controls, De - reservation commodities meant for small scale industries.

2. Financial sector reforms – reduced role of RBI from regulator to facilitator, removal on foreign borrowing limits, foreign investment was allowed, private banks were allowed.

3. Tax reforms – rates were lowered for direct and indirect taxes to improve voluntary disclosure and compliance and procedures were simplified.

4. Foreign exchange reforms: devaluation of rupee, market determined exchange rates.

5. Trade and investment policy reforms: with the aim to increase international competitiveness of Indian economy and infuse foreign capital and technology the liberalization of trade and investment regime was done. Import licenses and export duties were removed also quota on imports were abolished.

Privatization measures:

1. Government ownership of private companies was removed by outright sale of P.S.U or removal of government from managements of these companies.

2. Disinvestment which meant selling a part of the equity to private sector was started as private capital and managerial capabilities could be effectively utilized to improve working of P.S.Us.

3. P.S.Us were granted status of Navratnas and Maharatnas to grant operational autonomy to them.

Globalization:

Integrating economy of the country with the world.

1. Outsourcing became an outcome of Indian policies. The foreign companies hired cheap Indian talent. The growth of IT industry further fueled this. The low wage rates and availability of degree of skill and accuracy also influenced this phenomenon.

2. World Trade Organization [W.T.O] was founded as a successor to General Agreement on Trade and Tariff [G.A.T.T] in the Uruguay convention. India was a founder member and has been instrumental in deciding policies. W.T.O aims to reduce tariff and non tariff barriers amongst nations and ensure all countries take advantage of world’s trade.

Critics have pointed out that market driven globalization has increased trade disparity between developed and developing countries. The opening of trade has benefited the developed countries more as they have been able to access the developing markets. On the other hand the developing countries haven’t been able to compete in the markets of developed countries due to inferior goods.

Solved Question Papers

Q.With reference to India economy, consider the following statements:

1. The rate of growth of real Gross Domestic Product has steadily increased in the last decade.

2. The Gross Domestic Product at market prices (in rupees) has steadily increased in the last decade

Which of the statement given above is/are correct? (UPSC CSAT 2015)

1 only

2 only

Both 1 and 2

Neither 1 nor 2

Ans . B

Due to recession in 2008, the growth rate of the Indian economy had declined for the next few years from 8-9% to 5-6%. So, statement 1 is wrong.

Even though the growth rate declined, it never became negative. So, the GDP at market prices has always increased year on year since last one decade.

Q.A decrease in tax to GDP ratio of a country indicates which of the following?

1. Slowing economic growth rates

2. Less equitable distribution of national income

Select the correct answer using the code given below. (UPSC CSAT 2015)

1 only

2 only

Both 1 and 2

Neither 1 nor 2

Ans . A

Slowing economic growth rates mean less incomes for citizens and so less payment of tax. The ratio of tax/GDP shall be less only when tax paid is less and GDP is increasing than previous value.

so a slowing economic growth fulfils both conditions.