-

Chapter 8: BANKING CONCEPTS

Type of Deposits

1. Demand deposits: they are payable by the bank on demand from the account holder. E.g. Savings in bank accounts, current account, demand draft.

2. Time deposits: they have a fixed period of maturity. E.g. fixed deposits, recurring deposits, cash certificates, staff security certificates.

Note:

Time

deposits are more than demand deposits in banks.

N.T.D.L = net time and demand liabilities = time deposits + demand deposits.

Money supply:

Total stock of money in circulation with the public at any point of time is called Money Supply.

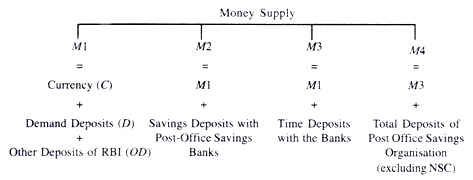

Measures of money supply:

1. M1 = currency in circulation with public [CU] + demand deposits in commercial banks [DD]

2. M2 = M1 + saving deposits held by post office banks

3. M3 = M1 + net time deposits held in commercial banks.

4. M4 = M3 + total deposits with post office banks[except national savings certificate]

M1, M2 are narrow money and M3, M4 are broad money. Liquidity increases from M4 to M1. M3 is the most popular measure of money supply known as aggregate monetary resource.

Fig 1: Money supply

Factors affecting money supply:

1. Currency deposit ratio: ratio of money held by public in currency to that they hold as deposits in banks.

C.D.R = CU / DD.

2. Reserve deposit ratio: proportion of total deposits banks keep in reserves.

3. Cash reserve ratio: fraction of the deposits banks must keep with RBI

4. Statutory liquidity ratio: fraction of the total demand and time deposits banks must keep in liquid assets.

5. High powered money or monetary base or reserved money [M0]: total liability of the monetary authority of the country. It consists of currency in circulation with public and vault cash with banks and deposits of commercial banks and government of India with RBI.

Money

multiplier = ratio of stock of money to the high powered money.

i.e. M3 / M0

When all depositors of the bank want their money withdrawn the bank will default. Hence in such situations the RBI acts as banker to banks / lender of the last resort and extends loans to ensure solvency of the latter.

RBI

also acts as banker to

the government. When governments can’t meet their expense

with their income, they print currency to meet the budget

deficit. In reality it involves selling of bonds to the RBI which issues currency to the

government in return. The money then ultimately comes in the

hands of the public and becomes a part of money supply.

Financing of budgets in this manner is called “deficit

financing from central bank borrowing”.

Open market operations: RBI purchases or sells government securities to the general public in the attempt to increase or decrease liquidity or stock of high powered money in the economy.

Marginal propensity to save is the proportion of the total additional income of the economy people wish to save as a whole. Marginal propensity to consume is the fraction of the total additional income people wish to consume. It the people of the economy increase the total proportion of income they save then the total value of savings in the economy will either decrease or remain same – paradox of thrift.

Debt: the government deficits have to be financed by either borrowing, taxation or financing. The government prefers to borrow thus creating government debt.

Open economy: a country that trades with other nations in goods and services and also in financial assets. The degree of openness of an economy is the ratio of total foreign trade [exports+ imports] to the country’s GDP.

Rates of RBI:

1. Bank rate: long term loan from RBI. No collateral needed.

2. Marginal standing facility: commercial banks can borrow from RBI at this rate [Repo+1]% and can use SLR securities as collateral. Limit is 0.75% of N.T.DL

3. Repo rate: all clients can borrow from RBI for short period at this rate but can’t use SLR securities as collateral. No limit to borrowing.

4. Reverse Repo rate: RBI pays this to its clients for short term loans [Repo – 1]%.

5. Statutory liquidity ratio: banks have to keep this much in gold, securities, cash etc. It is decided by RBI.

6. Cash reserve ratio: have to deposit this much cash with RBI but no interest earned.

Note: both S.L.R, C.R.R are counted on net time and demand liabilities [N.T.D.L = net time and demand liabilities = time deposits + demand deposits].

Inflation:

To reduce inflation: tight monetary policy, reduce money supply

To fight deflation: increase money supply, easy monetary policy.

Monetary policy instruments with the RBI:

1. Quantitative

a. Reserve ratio: CRR, SLR

b. Open market operations [OMO]

c. Rates: reverse repo, repo, marginal standing facility, bank rate

2. Qualitative

a. Rationing – ceiling of loans to specific sectors

b. Moral suasion

c. Direct action

d. Consumer credit control

e. Margin / loan to value – if customer wants to keep collateral of 1 kg gold worth 1 lakh and the LTV is 60% then bank can loan him only 60% of 1 lac= 60,000.

Qualitative instruments are selective and direct. Quantitative instruments are general and indirect.

During high inflation RBI increases CRR, SLR and the rates and sells government securities through open market operations [OMO] to reduce money supply. During deflation RBI decreases CRR, SLR, rates and buys G-Secs from public via OMO.

Monetary policy:

Monetary policy is currently decided solely by RBI governor but to fix responsibility a monetary policy committee needed with RBI governor [chairman] + deputy governor [vice chairman] + executive director and 2 outsiders.

Priority sector lending [PSL]:

Indian banks, foreign banks with more than 20 branches have to lend 40% of net loans given to priority lending sector in that year.

Foreign banks with less than 20 branches must give 32% of their net loans given to PSL in a year.

PSL consists of agriculture [18% out of 40% should go here], weaker sections [10% out of 40%] and remaining to housing, education, micro & small enterprises, retail trade, renewable energy, export credit. For foreign banks with less than 20 branches no sector specific targets but should reach 32%.

In case the Indian banks or foreign banks with 20+ branches don’t meet their target the amount of shortfall must be given to rural infrastructure development fund managed by NABARD. This is used to give loans to states and bank earns interest on it decided by RBI.

For foreign banks with <20 branches the shortfall goes to small enterprises development fund managed by SIDBI which is used to lend state industrial finance corporations and bank earns interest on it.

PSL applies only to commercial banks both public and private. It doesn’t apply to cooperative banks, regional rural banks, NBFC.

Financial inclusion:

It has four pillars:

1. Banking: savings, payments through branches, ATM, cheques

2. Credit: loans at affordable rates

3. Investment: mutual funds, pension plans

4. Insurance: life and non life insurance

Note: RBI mandates that banks should have 25% branches in rural areas. To open branches in urban areas [metro / tier 1-3 cities] RBI permission needed but no permission needed for tier 4-6 areas or north east states and Sikkim.

PM Jan Dhan Yojana:

Phase 1: to divide country into sub service areas with 1000-1500 families within 5 km distance. Each family gets 1 account, 1 RuPay debit card, Rs. 1 lac worth accident insurance. Rs. 5000 overdraft if good credit history.

Phase 2: direct benefit transfer, sell micro insurance and credit guarantee fund to cover losses.

Types of Banks:

Small banks:

1. 100 cr. Minimum capital. Large business houses and industrial houses can’t apply. FDI and voting rights same as commercial banks.

2. Focus on a small area for deposit and loans. 50% loans to MSME, 25% rural branches.

3. NBFC can convert to it; even individuals with 10 yrs experience in banking field can apply.

4. Can appoint business correspondents but can’t become BC for other banks.

5. Can’t have subsidiaries, NRI can apply, cooperative banks can’t. PSL target must be met in 3 yrs.

Payment banks:

1. Can have current and savings account but no time deposits.

2. Can’t give loans, must put entire investment in G-Secs. Must give interest on deposits.

3. Can’t have more than 1 lac in account per customer.

Cooperative banks:

1. CRR, SLR mandatory but no PSL.

2. 1 person in board has 1 vote. No profit no loss is motive.

3. Registered with the state registrar as a cooperative society. Regulator is NABARD.

4. Can be urban or rural. In rural it could be state cooperative, district or village cooperative.

Regional rural bank:

1. Present in only a few districts.

2.

Union

government

owns 50% + state 15% and sponsor bank 35%.

Regulator

is NABARD.

Wholesale bank:

1. Need to get registered under banking regulation act.

2. Can’t accept deposits less than Rs. 5 cr.

3. Can give loans to only large corporate and infrastructure

4. SARFAESI powers + CRR, SLR and PSL targets.

5. Wholesale investment bank have less than 20 branches and for them no need for 25% rural branches. They can’t act as bank saathi for other banks

6. Wholesale consumer banks have 20+ branches and they must have 25% rural branches. They can act as bank saathi for other banks.

All India financial institutions:

1. EXIM bank: export import bank. Loans, credit, finance to exporters and importers. Promotes cross border trade and investment. It is wholly owned by central government.

2. NABARD: national bank for agriculture and rural development. Owned by government 99.3% and RBI 0.7%. Regulatory authority for cooperatives bank and regional rural banks. Helps state cooperative banks and farmers, cottage industry.

3. National housing bank: apex institution for housing finance. 100% owned by RBI. Finance to banks and NBFCs for housing projects. Publishes RESIDEX [housing sector inflation]

4. SIDBI: owned by public sector banks and public sector insurance companies. Finance to state industrial development corporations, state finance corporations and banks.

Non banking finance corporation:

They are of two types: non banking and financial company. They get license under company act. Not all NBFC are regulated by RBI. Insurance NBFCs are controlled by IRDA and merchant banks by SEBI. Deposit taking NBFCs are allowed to take time deposit but not demand deposits.

No CRR but for deposit taking NBFC SLR is 15%. No PSL and entry capital is 5 cr. They take collateral as gold, bonds or shares. Only housing finance NBFC have SARFAESI powers i.e. to auction land of borrowers who can’t repay.

Types of NBFC:

1. Asset finance, infrastructure finance , infrastructure debt fund, investment companies, core investment companies, chit fund, loan company, factoring company – regulated by RBI

2. Insurance companies – regulated by IRDA

3. Housing finance companies – regulated by NHB

4. Stock broker, mutual fund, venture capital fund, merchant bank, investment banks – regulated by SEBI

Microfinance companies:

1. Regulated by dept. Of corporate affairs.

2. Entry capital 5 cr., can’t lend more than 50000 per person, loans without collateral, borrower fixes EMI, installments.

3.

Focus

on

women, poor.

Miscellaneous

Business correspondents or bank saathi:

Banks can’t open branches in all villages due to financial infeasibility. This creates hardship to the villagers as they have to travel long distances for accessing banking facilities. Thus to act as a link between villagers and banks in rural areas we have business correspondents.

BCA help villagers open account, help them in performing transactions; they have an electronic device which is used to process transactions. They also help villagers with loan applications, access insurance and micro credit.

A National asset reconstruction company is being considered to take over the bad assets of banks.The private ARC’s demand that bad assets be sold to them at a discount. However banks don’t sell assets to ARC’s as they fear prosecution from government agencies. Thus in this situation a National ARC may be a good option.

Bank + Insurance = BankAssurance:

Banks can sell insurance policies under three models.

Referral Model:

Insurance companies get office space in banks and insurance agents sell policies to people. Banks get a fixed fee from this.

Corporate Agent model.

One Bank can have a tie-up with a life, non life and a health insurance company. Bank can sell policies of only that company.

Broker model.

Banks sell policies of multiple insurance companies under one roof.

Note: NBFC's can sell insurance but only in Corporate Agent model. NBFC's with Rs. 100 crore funds and profit making in last three years can sell Mutual Funds. Banks can sell Mutual Funds but only after RBI's permission.

Financial Resolution and Deposit Insurance Bill, 2017: Bail-In provisions

The FRDI Bill seeks to establish a Resolution Corporation which will monitor the risk faced by financial firms such as banks and insurance companies, and resolve them in case of failure.

Some provisions of the Bill allow for cancellation or writing down of liabilities of a financial firm (known as bail-in). There are concerns that these provisions may put depositors in an unfavourable position in case a bank fails. In this context, we explain the bail-in process below.

What is bail-in?

The Bill specifies various tools to resolve a failing financial firm which include transferring its assets and liabilities, merging it with another firm, or liquidating it. One of these methods allows for a financial firm on the verge of failure to be rescued by internally restructuring its debt. This method is known as bail-in.

Bail-in differs from a bail-out which involves funds being infused by external sources to resolve a firm. This includes a failing firm being rescued by the government.

How does it work?

Under bail-in, the Resolution Corporation can internally restructure the firm’s debt by: (i) cancelling liabilities that the firm owes to its creditors, or (ii) converting its liabilities into any other instrument (e.g., converting debt into equity), among others.

Bail-in may be used in cases where it is necessary to continue the services of the firm, but the option of selling it is not feasible. This method allows for losses to be absorbed and consequently enables the firm to carry on business for a reasonable time period while maintaining market confidence. The Bill allows the Resolution Corporation to either resolve a firm by only using bail-in, or use bail-in as part of a larger resolution scheme in combination with other resolution methods like a merger or acquisition.

Do the current laws in India allow for bail-in? What happens to bank deposits in case of failure?

Current laws governing resolution of financial firms do not contain provisions for a bail in. If a bank fails, it may either be merged with another bank or liquidated.

In case of bank deposits, amounts up to one lakh rupees are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC). The Bill has a similar provision which allows the Resolution Corporation to set the insured amount in consultation with the RBI.

Does the Bill specify safeguards for creditors, including depositors?

The Bill specifies that the power of the Corporation while using bail-in to resolve a firm will be limited.

When resolving a firm through bail-in, the Corporation will have to ensure that none of the creditors (including bank depositors) receive less than what they would have been entitled to receive if the firm was to be liquidated.

Further, the Bill allows a liability to be cancelled or converted under bail-in only if the creditor has given his consent to do so in the contract governing such debt.

Do other countries contain similar provisions ?

The Financial Stability Board, an international body comprising G20 countries (including India), recommended that countries should allow resolution of firms by bail-in under their jurisdiction.