-

Chapter 11: Second Administrative Reforms Commission Part V

Financial Management

Public Finance Management - Public finance management includes resource mobilization, prioritization of programmes, the budgetary process, efficient management of resources and exercising controls.

Evolution of Budgeting

The line item Budget

Budgeting is the process of estimating the availability of resources and then allocating them to various activities of an organization according to a pre-determined priority.

In the late nineteenth century, line-item budgeting was introduced in some countries

The line item budget is defined as the budget in which the individual financial statement items are grouped by cost centers or departments.

In a line-item system, expenditures for the budgeted period are listed according to objects of expenditure, or line-items.

The line item budget approach is easy to understand and implement

Its major disadvantage is that it does not provide enough information to the top levels

Performance Budgeting

a performance budget reflects the goal/ objectives of the organization and spells out performance targets

A Performance Budget gives an indication of how the funds spent are expected to give outputs and ultimately the outcomes.

it is not easy to arrive at standard unit costs especially in social programmes which require a multi-pronged approach.

Zero-based Budgeting (ZBB)

under zero-based budgeting every activity is evaluated each time a budget is made and only if it is established that the activity is necessary, are funds allocated to it.

The basic purpose of ZBB is phasing out of programmes/ activities which do not have relevance anymore.

No government ever implemented a full zero-based budget, but in modified forms the basic principles of ZBB are often used.

Decision units in ZBB

A Decision unit is a distinct segment of an organization for which budget is prepared.

It can also be a programme, scheme, project, or an operation.

A decision package is a budget request which should contain the following :

A description of the function or activity of the decision unit

The goals and objectives of the various functions / activities of the unit

Benefits to be derived from financing the activity / programme in the present context.

The projected / estimated cost of the package

The yearly phasing of the proposed expenditure / project cost

Alternative ways of performing the same activity or achieving the same objectives.

Programme Budgeting and Performance Budgeting

Introduced in the US Federal Government in the mid-1960s

The basic building block of the system was classification of expenditure into programmes, which meant objective-oriented classification

It aimed at an integrated expenditure management system, in which systematic policy and expenditure planning would be developed and closely integrated with the budget.

Many governments today use the programme budgeting label for their performance budgeting system.

Weaknesses in the Budgetary Process :

Government budgets generally have the following shortcoming

Poor planning, Poor expenditure control;

No links between policy making, planning and budgeting;

Inadequate funding of operations and maintenance;

Inadequate accounting systems, Poor cash management;

Inadequate reporting of financial performance;

Almost exclusive focus on inputs, with performance judged largely in terms of spending no more, or less, than appropriated in the budget

Core Principles of Reforms

Reforms in Financial Management System are part of overall governance reforms

Sound financial management is the responsibility of all government departments/ agencies

Medium-term plan/budget frameworks and aligning plan budgets and accounts

Prudent economic assumptions: - Top-down budgeting techniques: Instead of bottoms up (offices telling departments how much they want).

Transparency and simplicity: - Relaxing central input controls:

Focus on results: - Adopting modern financial management practices

accrual accounting, information technology, financial information systems

Budgeting to be realistic

Existing Financial System Management in India

Financial Statements and Accounts

Budget is also known as the, Annual financial statement of the concerned Government (Articles 112 & 202)

The appropriations are required to be made in the manner provided in the constitution.

Constitution of India necessitate the maintenance of government accounts in three parts with regard to receipts

Consolidated Fund of India /States

Public account of India/States

Contingency Fund of India/States.

Annual Financial Statement

prepared according to General Financial Rules (GFR), General Accounting Rules (GAR), Budget Manual (in the States).

It is a statement of estimated annual receipts and expenditure is prepared by each Government and presented to its legislature.

The part of the estimates pertaining to expenditure charged upon the consolidated Fund is not submitted to the vote of the legislature

The part of the estimate which is concerned with other expenditures is submitted to the legislature concerned in the form of Demands for Grants

A separate demand is presented for each Department or the major services under the control of a Ministry/Department

The Finance Bill containing the annual taxation proposals is considered and passed by the legislature only after the Demands for Grants have been voted and the total expenditure is known.

After the Demands have been passed by the legislature, an Appropriation Bill is introduced to provide for the appropriation out of the consolidated Fund of India

Fiscal Responsibility and Budget Management Act, 2003

Three Statements are to be presented to the Parliament, which form a part of the budget documents

Macro-economic Framework Statement - contains an assessment of the growth prospects of the economy

Medium term Fiscal Policy Statement

three-year rolling targets for four specific fiscal indicators in relation to GDP at market prices, namely, (i)Revenue Deficit, (ii) Fiscal Deficit, (iii)Tax to GDP Ratio, and (iv) Total Out-Standing Debt

Fiscal Policy Strategy Statement - seeks to outline the strategic priorities of the Government in the fiscal area for the ensuing year.

Division of Budget

Within each of the divisions and Sections of the consolidated Fund as referred to above, the transactions are grouped into Sectors such as,

General Services, Social Services, Economic Services, under which specific functions or services are placed

These Sectors are further sub-divided into `Major Heads of Account'

In some specific cases, the Sectors are sub-divided into sub-sectors before their division into Major Heads of Account.

The Sectors, Major heads, Sub-heads and Detailed heads together constitute a five-tier arrangement of the classification structure of Government Accounts.

The Major Heads of Account falling within the consolidated Fund generally correspond to `Functions' of Government

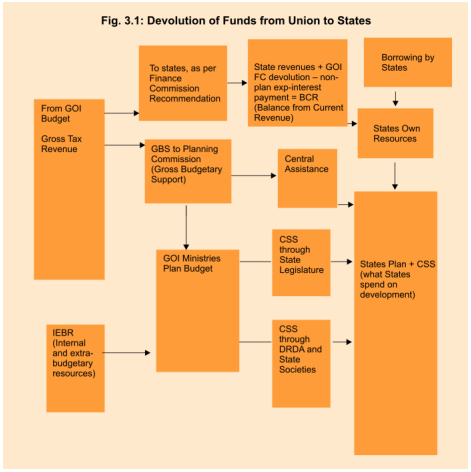

Flow of Funds Related to Union Government Programmes

The first is by way of devolution as per the recommendations made by the Finance commission (in terms of Articles 280 and 281 of the constitution)

The second is through the Planning commission.

the States receive Plan funds from the Planning commission in the form of `central Assistance' under the `Scheme of Financing of States' Annual Plan.

`Centrally Sponsored Schemes' (CSS)

The centrally Sponsored Schemes do not fall within the subjects allocated to union Government in list I of the Seventh Schedule of the constitution.

However, they are funded by the union Government to achieve certain national objectives

Actual expenditure under the CSS is incurred only when payment is made either to a beneficiary of the scheme or to the supplier of goods and services.

Preparation of the Budget

Preparation of the Annual Budget in the Government of India follows both the top-down and bottom-up approaches.

While guidelines and instructions are issued by the Ministry of Finance and Planning commission, the spending Ministries/Departments make requests for budgetary allocations based on their own estimates.

The provisions which govern the preparatory process are contained in the General Financial Rules.

Weaknesses in the Budgetary System and Implementation

Unrealistic budget estimates:

Delay in implementation of projects:

Skewed expenditure pattern:

a major portion getting spent in the last quarter of the financial year, especially in the last month.

Inadequate adherence to the multi-year perspective and missing `line of sight' between plan and budget:

No correlation between expenditure and actual implementation:

Parking of funds by implementing agencies, outside the government accounts portrays an incorrect picture of the financial position of government.

Mis-stating of financial position:

Ad hoc project announcements:

Irrational plan / non-plan distinction leads to inefficiency in resource utilization.

Recommendations

The assumptions made while formulating estimates must be realistic.

The gap between the `estimates' and `actuals' must be ascertained and efforts made to minimize them

The method of formulation of the annual budget by getting details from different organizations/units/agencies and fitting them into a pre- determined aggregate amount leads to unrealistic budget estimates.

This method should be given up along with the method of budgeting on the basis of `analysis of trends'.

This should be replaced by a `top-down' method by indicating aggregate limits to expenditure to each organization/agency.

Internal capacity for making realistic estimates needs to be developed.

The practice of announcing projects and schemes on an ad-hoc basis in budgets and on important National Days, and during visits of dignitaries functionaries to States needs to be stopped.

Outcome Budget :

Announced in Budget speech of the Finance Minister (Budget 2005-06)

The first outcome budget was passed in the Parliament on August 25, 2005

The guidelines have prescribed the following steps

Defining intermediate and final outcomes specifically in measurable and monitorable terms

Standardizing unit cost of delivery

Benchmarking the standards/quality of outcomes and services

capacity building for requisite efficiency at all levels

Ensuring adequate flow of funds at the appropriate time to the appropriate level

effective monitoring and evaluation systems

Involving the community/target groups/recipients of the service, with easy access and feedback system

`Outputs' have been defined as the `measure of the physical quantity of the goods or services produced through an activity under a scheme or programme'

They are identified as an intermediate stage between `outlays' and `outcomes'.

`Outcomes' are the end product/results of various Government initiatives and interventions

They cover the quality and effectiveness of the goods or services produced as a consequence of an activity under a scheme or programme.

For the year 2007-08, the Outcome Budget and Performance Budget were merged and placed in one combined document.

ARC's view

Outcome budgeting is a complex process and a number of steps are involved before it can be attempted with any degree of usefulness.

A beginning may be made with proper preparation and training in case of the Flagship Schemes and certain national priorities.

Distinction between Plan and Non-Plan

The distinction has led to ever increasing tendency to start new schemes/projects to the utter neglect of maintenance of existing capacity and service levels.

leads to the misperception that non-plan expenditure is inherently wasteful and should be avoided.

Non-Plan expenditure covers expenditure on security, interest payments and subsidies etc

ARC' view: The Plan versus non-Plan distinction needs to be done away with.

Development of Financial Information System

Advantages

Providing timely and reliable information to the decision makers

Providing inputs to control systems

Monitoring financial and physical progress

Ensuring proper utilization of resources

Presently, all Federal Government units (Executive, legislation and Judiciary) in Brazil including all State/owned company units are required to use SIAFI.

ARC: A robust financial information system, on the lines of SIAFI of Brazil, needs to be created in the government in a time bound manner.

Accrual System of Accounting

Principles of Government Accounting

The accounting methods adopted for commercial concerns, and the preparation of Manufacturing, Trading and Profit and Loss Accounts and a Balance Sheet, in the commercial sense, are, therefore, unsuitable and unnecessary.

On the basis of the budget and the accounts, Government determines

(a) whether it will be justified in curtailing or expanding its activities

(b) whether it can and should increase or decrease taxation accordingly.

Methods of Government Accounting - The mass of the Government accounts being on cash basis is kept on Single Entry. A portion of the accounts which is kept on the Double Entry System for profitable activities,etc.

Accrual Accounting

In a loan given, the World Bank included the introduction of accrual accounting as a part of its conditions

Issues with Cash based system

The cash-based system of accounting lays emphasis on transactions vis-à-vis the budget.

It does not record and report complete financial information required for management of resources

It does not provide a full picture of the government's financial position at any given point and the changes that take place over time as a result of government policy.

The system fails to reflect government's liabilities such as accrued liabilities arising due to unfunded pensions and superannuation benefits and current liabilities arising from a disconnect between commitments and payments

Similarly, the present system is unable to track current assets as well as non-financial assets.

Accrual System

The system of accrual accounting recognizes financial flows at the time economic value is created, transformed, exchanged, transferred or extinguished, whether or not cash is exchanged at that time

Expenses are recorded when the resources (labour, goods and services and capital) are consumed, and income when it is earned, i.e. when the goods are sold or the services rendered.

Twelfth Finance commission

The change over to the accrual based system of accounting will place considerable demands on the accounting personnel in various government organizations

A Task Force should be set up to examine the costs and benefits of introducing the accrual system of accounting.

Internal Control and Audit

Weaknesses of the Present System of Internal Audit - comptroller and Auditor General of India had constituted a task force at the request of the Ministry of Finance in July 2006 for benchmarking the status of internal audit in the union Government.

Task Force observed the following:

Serious deficiencies in the existing internal audit system making it inadequate and ineffective

The internal audit guidelines are outdated and there are no manuals in many cases.

There are also no prescribed internal auditing standards.

Under-resourcing of the internal audit service and shortage of manpower

The limited staff of the internal audit is also sometimes diverted for accounting and budgeting purposes.

There was no segregation of duties especially at supervisory levels between those who are responsible for internal audit and those responsible for pre-audit, disbursement and accounting functions.

Independence is hampered in two ways.

Internal audit vested with the chief controllers of Accounts, who were also responsible for accounting and payment functions

Financial Advisers are enjoined to `review the progress of internal audit'.

Recommendations

An Office of the Chief Internal Auditor (CIA) should be established in select Ministries/departments to carry out the functions related to internal audit.

CIAs should be directly responsible to the Secretary of the Department.

Standards for internal audit should be prescribed by the Office of the C&AG

The Accounting functions should be completely separated from Internal Audit.

Integrated Financial Adviser

The role of the chief Accounting Authority - be responsible and accountable for financial management of his Ministry or department;

be responsible for the effective, efficient, economical and transparent use of resources of the Ministry or Department

be responsible for preparation of expenditures and other statements

shall ensure that his Ministry of Department maintains full and proper records of financial transactions

Relationship between Auditor and Auditee

Recommendations

There is need for better understanding and synergy between the audit and auditees for enhanced public accountability and consequently better audit impact.

There should be balanced reporting by the audit.

There is need for increasing interaction as well as coordination between the executive and the audit, including at senior levels.

Timeliness of Audit and concurrent Audit

concurrent performance audit of long-term on-going schemes should be undertaken at appropriate intervals.

External audit needs to be more timely in inspecting and reporting so that their reports can be used for timely corrective action.

All audits for the year under review should be completed by 30th of September of the following year

IT should be used increasingly and effectively for data collection and analysis.

The pending audit paras should be monitored by having a database on them in each Ministry/Department.

External Audit and Parliamentary Control

External audit has a very important role to play in financial management

provides assurance to Parliament/legislature that public money has been spent for the purpose for which it was sanctioned by the Parliament/legislature

is a crucial element of public accountability as it is an independent external scrutiny.

is a deterrent against careless decision-making and irresponsible attitude towards public expenditure and project management

is expected to establish public confidence that public money is being properly spent.

External audit includes examination of the economy, efficiency and effectiveness

is expected to help in achieving full value for money

The Comptroller and Auditor General of India - To promote excellence in public sector audit and accounting services towards improving the quality of governance.

Types of Audit

Performance Audit, slowly developed as an attempt to measure the economy, efficiency and effectiveness of the Government expenditure.

Performance Audit, Regularity (Financial) Audit, Regularity (compliance) Audit, IT Audit

Strengths of External Audit in India

The CAG has a high status enshrined in the constitution, upheld by long traditions of public audit in India.

The institution of audit under the CAG is often regarded as the fourth pillar in the democratic setup and an essential instrument of financial control and accountability.

The constitution of India ensures independence and autonomy of the public audit.

The expression `Audit' or scope of the audit has not been defined either in the constitution or the CAG's DPC Act, 1971

The scope of external audit is, therefore, wide.

Audit can respond to changes, reforms, new initiatives, changing patterns of Government activities, international developments in the profession and rising expectations of the stakeholders regarding public accountability.

The CAG has the power to determine the nature and extent of audit and related access to records and to relevant information.

The CAG has the inherent right to determine what should be included in the Audit Reports.

There is a requirement that Audit Reports should be tabled in the Parliament/ legislature and thereafter these become public documents.

There are well documented Audit Manuals and audit guidelines for the Auditors to follow.

Auditing Standards framed on lines of INTOSAI (International Organization of Supreme Audit Institutions) guidelines are available

Challenges before the External Audit

There is hardly any accountability for not taking timely action on audit observations.

There is a feeling that the CAG's reports are sometimes not timely because there is substantial time gap between occurrence of an irregularity and its reporting by Audit.

CAG's audit itself is post facto - its findings and recommendations may be too late for corrective action.

Audit findings are based exclusively on documents and files

There is a feeling that external audit reports tend to be unduly negative and their focus is on irregularities and fault finding.

Audit does not always recognize the practical constraints under which the Government/Government Agencies function.

Audit often does not discriminate between errors arising out of bonafide intentions/malafide intentions.

Audit Reports are not always presented in a sufficiently constructive manner

Audit must therefore identify systemic problems.

Audit does not give due credit for good performance.

The relationship between the auditor and auditee is not always harmonious.

Audit is viewed as a system for policing Government Organisations.

There is inadequate synergy/coordination between external audit and internal audit.

There is rarely any audit of grants and loans to NGOs.

Accountability to Parliament

PAC

In scrutinizing the Appropriation Accounts and the Report of the C&AG thereon, the committee checks

that the moneys shown in the accounts as having been disbursed were legally available for, and applicable to, the service or purpose to which they have been applied or charged;

that the expenditure conforms to the authority which governs it;

that every re-appropriation has been made in accordance with the provisions made in this behalf under rules framed by competent authorit

to examine the statement of accounts showing the income and expenditure of autonomous and semi-autonomous bodies,

to consider the report of the comptroller and Auditor-General in cases where the President may have required him to conduct an audit

Departmentally related Standing committees

The general procedure relating to Demands for Grants

after the general discussion on the Budget in the two Houses is over, the Houses shall be adjourned for a fixed period

the committees shall consider the Demands for Grants of the concerned Ministries during the aforesaid period;

the committees shall make their report within the period and shall not ask for more time;

the Demands for Grants shall be considered by the House in the light of the reports of the committees

there shall be a separate report on the Demands for Grants of each Ministry.