-

Chapter 5: MACROECONOMICS

Developing and Developed economies

The World Bank in its World Development Report (2010) classified the various countries on the basis of Gross National Income (GNI) per capita

Developing countries are divided into

Low income countries with 2009 GNI per capita of $ 936 and below

Middle income countries with GNI per capita ranging between $ 936 and $ 11,455

High income Countries which are mostly members of the Organisation for Economic Cooperation and Development and have Per capita GNI of $11456 or more.

Middle income countries are currently 72% of all countries of the world followed by high income (16%) and then low income (11%).

World Bank, World Development Indicators show that have a high average annual growth rate of GDP than middle income and high income economies.

However not all high income economies are developing as oil exporting countries are not developed but have a high income due to exports.

BASIC CHARACTERISTICS OF THE INDIAN ECONOMY AS DEVELOPING ECONOMY

India is a low income developing economy. There is no doubt that nearly one-fourth of its population lives in conditions of misery. Poverty is not only acute but is also a chronic malady in India. At the same time, there exist unutilised natural resources.

Low per capita income:Developing economies are marked by the existence of low per capita income. The per capita income of an Indian in 2010 was $ 1270. Barring a few countries, the per capita income of the Indian people is the lowest in the world. During 1960-80, developed economies grew at a faster rate than the Indian economy, but during 1990-2010, Indian economy has grown at a faster rate than the developed economies. Even then the difference in per capita income between India and the developed economies is quite large.

Occupational pattern : primary producing:India has a large percentage of its population under agriculture. Agriculture has become the prime moving force of the economy from the 21st Century. Earlier it was industrialization which was treated as the prime moving force. However India is also regarded as a "Market failure" as a large percentage of population is engaged in jobs that are of poor productivity and so they can't have enough purchasing power to buy goods that are produced. This in turn means that less goods have to be produced and industrialization cant work at full pace and capacity.

Heavy Population pressure : A rising population imposes greater economic burdens and, consequently, society has to make a much greater effort to initiate the process of growth. Moreover, a rising population leads to an increase in the labour force. This rapid growth of labour force creates a higher supply of labour than its demand leading to unemployment.

Prevalence of chronic unemployment and underemployment :In India labour is an abundant factor and, consequently, it is very difficult to provide gainful employment to the entire working population. In developed countries, unemployment is of a cyclical nature and occurs due to lack of effective demand. In India unemployment is structural and is the result of a deficiency of capital. The Indian economy does not find sufficient capital to expand its industries to such an extent that the entire labour force is absorbed

Steadily improving rate of capital formation:The amount of capital available per head was low and secondly the rate of capital formation was also low. The consumption of energy is an indicator of low capital available per head and this is low in India.

Gross fixed capital formation (GFCF):It refers to the net increase in physical assets (investment minus disposals) within the measurement period. For a country whose population is growing at 1% per annum, GCF should be 4% per annum. India has currently very high GCF.

Maldistribution of Wealth/Assets:Inequality in asset distribution is the main cause of unequal distribution of income in the rural areas. It also signifies that the resource base of 50 per cent of the households is so weak that it can hardly provide them anything above the subsistence level of income.

Poor quality of human capital A glaring feature of an underdeveloped economy is the poor quality of human capital. Most of the underdeveloped countries suffer from mass illiteracy. Illiteracy retards growth. A minimum level of education is necessary to acquire skills as also to comprehend social problems. Rural areas where illiteracy is a rule, are the back-waters of civilization and the centres of superstition, social taboos and conservatism. Fatalism and acceptance of misery as a part of life and belief in a pre-destined order are all accompanied by mass illiteracy

Prevalence of low level of technologyThe technology used in manufacture makes a huge difference in the quality of the output and enables a product to compete with others. In the era of globalization the economy of a country has become exposed to the world economy and Indian industries are not able to compete with global brands. This is due to twin problems of lack of capital to purchase equipments and a lack of a trained force to use them.

Low level of living of the average Indian:Since nearly 28 per cent of the population in India lived below the poverty line in 2004-05, it is very doubtful whether the poor get a minimum intake of even 2,100 calories. Another factor that has an important bearing on the health of the people is that in India cereals predominate, but in developed countries protein rich foods are consumed.

Demographic characteristics of an underdeveloped country:Most of the developed nations have a higher population in the old age segment and this means a majority of the population is non productive. This is in contrast to India where a majority of the population is in the working age. However India must focus on skilling its workforce so that it can take advantage of newer and better employment opportunities.

The Socio-economic indicators of consumption are characteristic of underdeveloped economy in India

Deficits and their Definitions

Budget deficit [BD] = government expenditure - government income

Trade deficit = import expenditure – export revenue

Effective revenue deficit [ERD] = revenue deficit – grants given to state for building capital assets

Revenue deficit [RD]: refers to the revenue expenditure being in excess of revenue deficit.

Revenue deficit = revenue expenditure – revenue income

Fiscal deficit [FD]: difference between the government’s total expenditure and its total receipts including borrowing.

Gross fiscal deficit = net borrowing from home + borrowing from RBI + borrowing from abroad.

Primary deficit [PD]: gross fiscal deficit – net interest payments.

The Fiscal Responsibility and Budget Management Act want to reduce fiscal deficit to 3% of GDP by 31-3-2017 and E.R.D to 0% of GDP by 31st march 2015.

F.D > R.D > E.R.D > P.D > B.D

Non plan expenditure > plan expenditure

Revenue receipt > capital receipt

National Income and Gross Domestic Product

The macroeconomic variable that considers the addition when the Indian worker earns in foreign countries and subtractions of income earned by foreigners in India is called gross national product.

GNP = GDP + factor income earned by domestic factors of production employed in foreign – factor income earned by foreign factors of production employed in India.

NNP = GNP – depreciation.

When the indirect taxes and subsidies are adjusted from the N.N.P we get N.N.P at factor cost or national income.

NI = N.N.P at market prices – indirect taxes + subsidies

Net disposable income = N.N.P [market price] + current transfers [salaries, pensions, fees transferred abroad]

Real GDP is the GDP is the GDP that is evaluated by considering the goods and services at a constant rate.

Nominal GDP is the GDP that is evaluated at the current prevailing price.

GDP deflator = nominal GDP / real GDP

In the absence of indirect taxes or subsidies the GDP is equal to the national income.

Consumer and Wholesale Price Index

Consumer price index and

wholesale price index are ways to measure change of prices in an

economy. We calculate the prices of commodities in two years –

base year and current year. The latter is expressed as a

percentage of the former. This gives us the CPI / WPI of that

year.

GDP is taken as a measure of welfare of a country but it isn’t one as:

1. Distribution of GDP isn’t uniform and it may indicate an increase but this can be concentrated in a handful of people and the majority might be worse off. This means that the GDP isn’t an indicator of the well being of the people.

2. Non monetary exchanges: many activities aren’t evaluated in non monetary terms. Barter exchanges are not in monetary terms and hence don’t get registered in the GDP. This is a case of underestimation of GDP. Hence the GDP of a country doesn’t give an indication of productive activity or well being of a country.

3. Externalities are the benefits or harm an entity causes to another for which it doesn’t pay. Example, if a factory producing goods disposes wastes in the river then the pollutant can kill the fishes and harm the livelihoods of fishermen. The factory doesn’t pay and hence such negative externality isn’t counted in the GDP. There could be positive externality too. Hence GDP might not indicate the actual welfare of the people.

Note:

National income [Rs. 84 lac Cr.] and the Per capita income [Rs.

74000] have been rising every year. Share of services in the

Gross Value Added at basic price [current] is 60% (including

construction) and in that highest share is of “Financial and

real estate service”.

Money Supply

Velocity of circulation of money: the number of times a unit of money changes hands during a unit period of time.

When the interest rate is high people expect it to fall and so convert their money into bonds. Thus speculative demand for money is low. When people feels the rates are too low they convert bonds to money anticipating an increase in the interest rates. Thus speculative demand for money is higher.

Speculative demand for money is inversely proportional to rate of interest.

External Trade

Balance

of

payments [BOP]: it is a record of

transactions of goods, services and assets of residents of a

country with the rest of the world.

BOP has two components – current account and capital account.

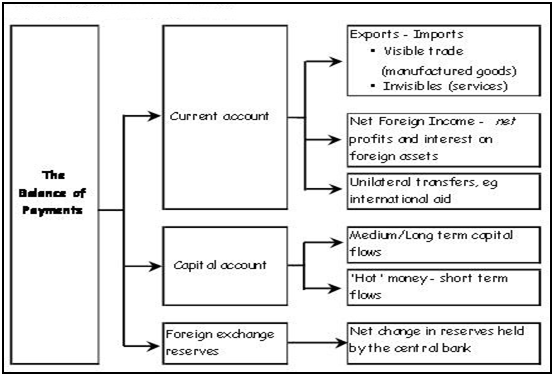

Fig 1: Balance of Payments

components

Current account records exports and imports in goods and services and transfer payments. Trade in services is called as invisible trade as they aren’t seen to cross national borders. This includes factor income and non factor income.

Transfer payments are receipts which a country’s citizens receive for free i.e. Remittances, gifts, grants. India is number 1 in receiving remittances [approx $70 billion].

India has a current account deficit as the import of goods is higher than the income received from remittances and services. But India has a capital account surplus due to large FDI, FII and external borrowings. The overall BOP is positive for India.

Balance of trade [BoT]: balance of exports and imports of goods.

A country is said to be in Balance of Payments equilibrium when the sum of current account and

capital account is zero.

When a country has negative balance of payments its monetary authority sells foreign exchange to finance deficit. When the country has positive balance of payments its monetary authority buys foreign exchange.

BOP being positive is usually bad

for exporters as the rupee appreciates and BOP negative is usually bad for importers

as rupee weakens.

Fig 2: Balance of trade

Foreign Exchange Reserves of India

- Gold reserves with RBI

- Foreign exchange assets with RBI

- Special drawing rights with IMF

- Reserves of foreign exchange in IMF.

BALANCE OF TRADE AND BALANCE OF PAYMENT

The exports and imports of a country should be roughly equal in value, since the foreign exchange earned by exports is necessary to finance imports, but such a balance is rarely achieved.

The difference in value between imports and exports is referred to as the balance of trade. If exports exceed imports a country is said to have a favourable balance of trade, while if imports exceed exports it has an adverse balance of trade.

The balance of trade only takes account of visible trade or the value of actual goods transferred from one country to another. But there are many other ways in which foreign exchange can be earned or spent. These are collectively called invisible trade which accounts for a quarter of all transactions with foreign countries can be worked out. This is called the balance of payments.

Transactions which bring money into the country are called invisible exports and can be of several kinds.

Payment for financial services including insurance, banking, brokerage, and other services carried out on behalf of foreigners.

Payment of transport services such as shipping or air transport of passengers or freight. Britain and certain other European countries have large invisible earnings in these two fields because of their importance in trade and financial dealings.

Expenditure by foreign tourists. This is often an extremely important source of foreign exchange.

Interest and dividends on foreign investments. India is earning a substantial amount in the form of interest and profit on foreign investment, annually.

Remittance from emigrants. Many emigrants send money to their families and thus countries like India, which have supplied large number of emigrants, may receive considerable foreign exchange in this way.

Loans and aids from foreign countries or international organisations. Many underdeveloped countries receive aid or loans to finance development, while other countries may obtain loans to cover balance of payments deficits.

Solved Question Papers

Q.With reference to Balance of Payments, which of the following constitutes/constitute the Current Account?

Balance of trade

Foreign assets

Balance of invisibles

Special Drawing Right

Select the correct answer using the code given below. (UPSC CSAT 2014)

1 only

2 and 3

1 and 3

1, 2 and 4

Ans . C

Balance of Trade and Balance of invisibles are part of “Current Account”.

Q.Which of the following organizations brings out the publication known as ‘World Economic Outlook’? (UPSC CSAT 2014)

The International Monetary Fund

The United Nations Development Programme

The World Economic Forum

The World Bank

Ans . A

World Economic Outlook is released by IMF

Q.The substitution of steel for wooden ploughs in agricultural production is an example of (UPSC CSAT 2015)

labour-augmenting technological progress

capital-augmenting technological progress

capital-reducing technological progress

None of the above

Ans . B

Capital” in an economic context means machinery or capital goods which can be employed to produce other goods.

Substitution of steel can be considered as the substitution of a lesser machine by a better machine. This encourages steel production. Hence it is a capital-augmenting technological progress.

Q.The problem of international liquidity is related to the non-availability of (UPSC CSAT 2015)

goods and services

gold and silver

dollars and other hard currencies

exportable surplus

Ans . C

The concept of international liquidity is associated with international payments.

These payments arise out of international trade in goods and services and also in connection with capital movements between one country and another.

International liquidity refers to the generally accepted official means of settling imbalances in international payments which is basically dollars and hard currencies.

Q.In the Index of Eight Core Industries, which one of the following is given the highest weight? (UPSC CSAT 2015)

Coal Production

Electricity generation

Fertilizer Production

Steel Production

Ans . B

Electricity has 10.32% weightage; steel 4.9%; coal 4.38%; fertilizers 1.25%.

Q.With reference to Union Budget, which of the following, is/are covered under Non-Plan Expenditure?

Defense -expenditure

Interest payments

Salaries and pensions

Subsidies

Select the correct answer using the code given below. (UPSC CSAT 2014)

1 only

2 and 3 only

1, 2, 3 and 4

None

Ans . C

Non plan expenditure is all expenditure which is incurred every year and not a part of state and central five year plan. It is salary, pensions etc which doesn't build capital in the economy.

Q.The sales tax you pay while purchasing a toothpaste is a (UPSC CSAT 2014)

tax imposed by the Central Government.

tax imposed by the Central Government but collected by the State Government

tax imposed by the State Government but collected by the Central Government

tax imposed and collected by the State Government

Ans . D

Sales tax is a tax levied and collected by the State.