Introduction to Fiscal Framework - World is Changing should India change too?

The government has succeeded in reducing the burden of the fiscal deficit from 4.5 % of the GDP to the current level of 3.2% of the GDP. The Governments all around have changed the policy of their country in the face of the Global financial crisis and have taken measures like quantitative easing, negative interest rates, bond buyback programs etc. to boost the economy.

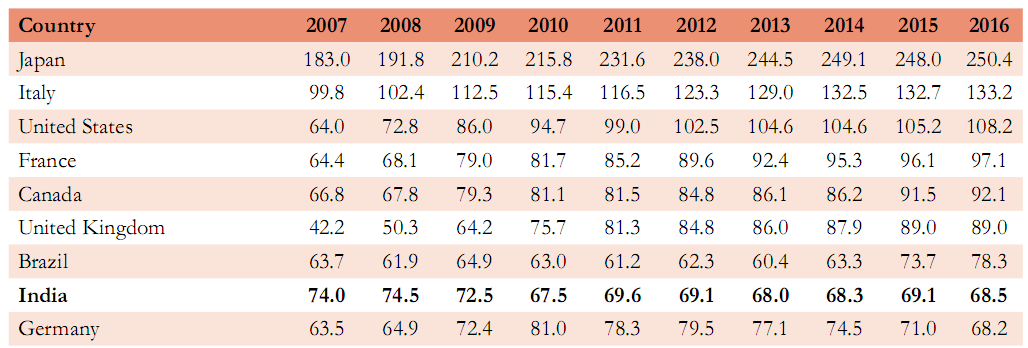

The Government has also maintained a good Debt to GDP ratio and although this has been high compared to other emerging economies, it has not reached unmanageable levels. India has also been very willing to meet its debt obligations and hasn't defaulted on loans to external debtors even during near crisis like situations in 191 and 1993.

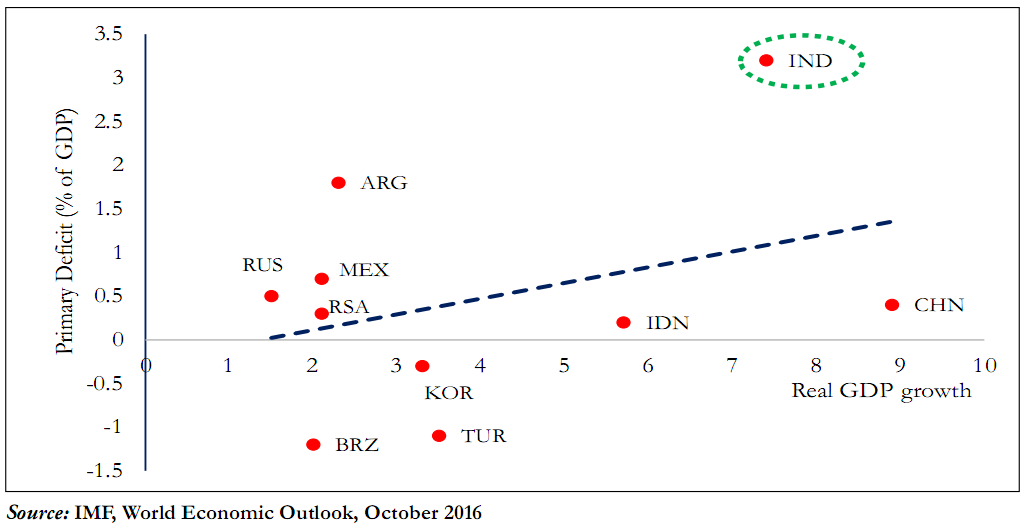

The Government's both the States and the Center however have a vulnerability too - They haven't been able to collect enough revenue to meet their running costs. Hence the primary deficit - Difference between the Government's revenue and its non interest expenditure is higher compared to other countries. Although many countries face a Primary deficit as after the Global Financial crisis the spending schemes have been greater and revenues lower. However their growth rates too are low. By comparison the Indian growth rate and the consequent primary deficit are abnormally high.

The Primary deficit problem could become a major issue if tomorrow the growth rate reduced and India was forced to increase spending to meet the downturn. In such a case the Primary deficit would rise again and then we would have a situation like Greece!!.

Fiscal Lessons from the States

The States have shown the way in fiscal prudence by reducing the revenue deficit to 0 and the fiscal deficit to 3% of their GSDP. The reason for this is reduction in spending schemes, greater outlay from the center, more expenses from the centrally sponsored schemes, reluctance in borrowing, reducing wasteful expenses etc. The majority of the states have managed to reach the targets set in their respective Fiscal responsibility legislation's. The Center however should lead from the front by paring its own deficit and becoming a model for the state.

The reason for the increasing need to maintain fiscal discipline in the state's finances is that the 7th Pay commission, increase in bond payments from UDAY bonds, other expenses shall increase for the states. This time however they shall not be able to maintain the high growth rate that they did earlier.

The 14th Finance commission had rolled back the incentive provided by the 13th Finance commission of giving monetary incentives to states who had good fiscal performance. There should be a consideration to go back to this system.

Clothes and Shoes - Can India reclaim low skilled Manufacturing?

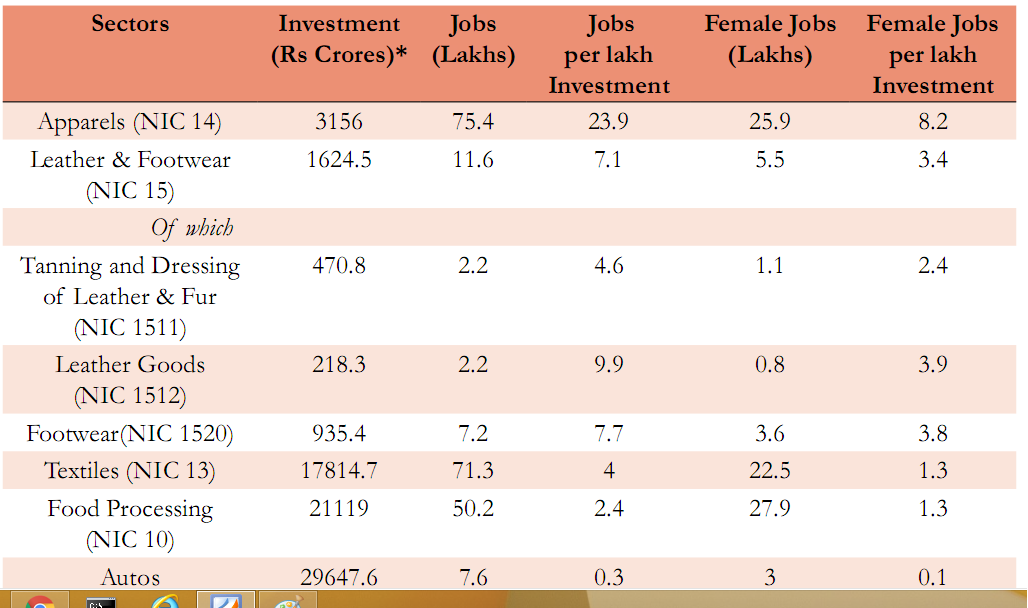

Sectors such as manufacturing of leather and textiles can boost Indian economy in two ways. It can provide jobs to semi and unskilled workers on a large scale and second it can boost employment of women and employment of rural youth. Manufacturing also has a second advantage that it can create jobs in the service sector too [three times more].

Certain factors that favor India in this are the appreciation of yuan and China's labor problems. This means Indian manufacturing can become competitive if India agrees to have a stable taxation regime, sign free trade agreements with major buyer nations like EU and US. This shall make Indian made clothes competitive compared to Vietnam and Bangladesh the nearest competitors.

The reason for targeting leather and apparel sector is also because the relation between the investment needed and the subsequent output in terms of jobs and also the impact in terms of bringing social change. The East Asian countries too have relied on this sectors for their growth stories in the post war period. In some of these nations the growth of the apparel, footwear and the leather sectors was as high as 50% every year and this boosted their economies. The female literacy, fertility rates, participation in the labor force also moved in a positive direction after the boost to the apparel sector.

However the wage growth in China means that manufacturing can move to India but due to laxity the jobs are moving to Ethipia, Vietnam, Bangladesh and Indonesia and a shift in strategies is needed before it is too late.

Common Challenges:

Logistics: The cost of taking a shipment from the factory to market or destination is very high in India compared to other countries. This impedes the competitiveness of Indian manufacturing. Secondly very few Very large cargo containers come to India and thus our shipments have to routed through Colombo and this increases costs further.

Labor costs: Compliance with labor regulations, high employment benefits to workers, inflexible work hours and meeting other obligations of the Industrial and employment act means that Indian industries are small scale to avoid coming into the jurisdiction of these Acts. This leads to less manufacturing and small economies of scale. Compared to other countries India has low number of large firms.

Tax: India has higher tax on man made fiber clothes and non leather goods than on cotton based and leather based goods. The World demand is increasing for man made fiber clothes and non leather based goods and so there is an urgent need to rationalize taxes on them to meet global demands.

Free Trade Agreements: Countries like Bangladesh, Ethiopia and Vietnam enjoy a lower tariff on goods and leather/apparels compared to India. India thus needs to sign a FTA with US and EU and get a boost to its manufacturing or else give value addition on its manufactured items.

Cattle Slaughter ban: Although in India there is no ban on slaughtering of bullocks but Cattle based leather goods are more in demand due to their superior quality, durability etc. The country although has a huge population of cattle but legislations prevent us from exploiting it for our advantages.

Review of Economic Developments?

Central Statistics Office of the Ministry of Statistics released the GDP Advanced estimates of the first half of the year and then the second half early due to the advance in the budget date by a month. However the estimates were based on the pre demonetization level of growth of the economy and so may be revised downwards.

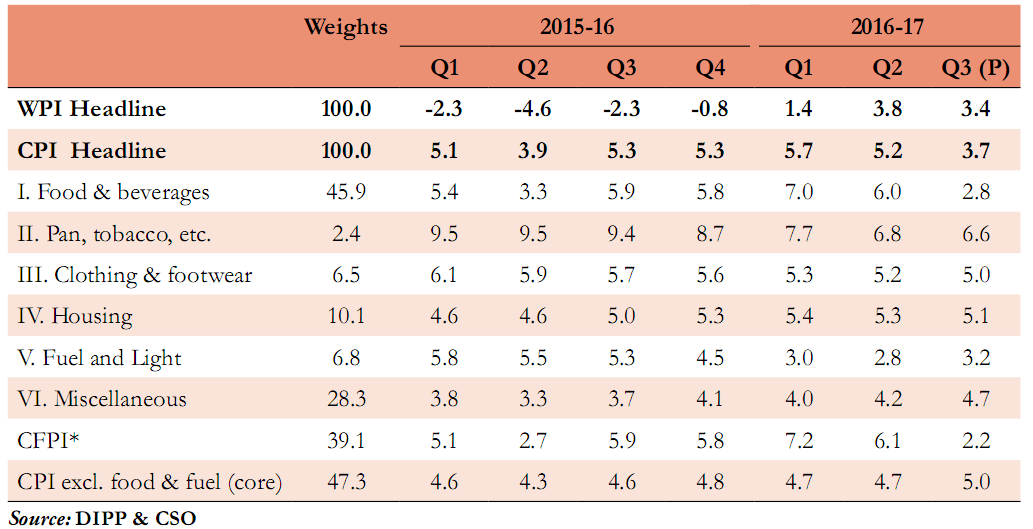

The chart indicates the inflation trends of CPI / WPI:

The Core CPI i.e. excluding weigths of food and fuel is has larger share than non core CPFI [Consumer price food index].

For social empowerment, the ‘Nai roshni’ scheme for leadership development of minority women, ‘Padho Pardesh’, a scheme of interest subsidy on educational loans for overseas studies for the students belonging to the minority communities, etc. are being implemented. For skill development and economic empowerment of minorities, schemes like 'Seekho Aur Kamao' (Learn & Earn), Upgrading Skill and Training in Traditional Arts/Crafts for Development (USTTAD) and ‘Nai Manzil’- a scheme to provide education and skill training to the youth from minority communities are in operation.

Chapter Review

Score more than 80% marks and move ahead else stay back and read again!